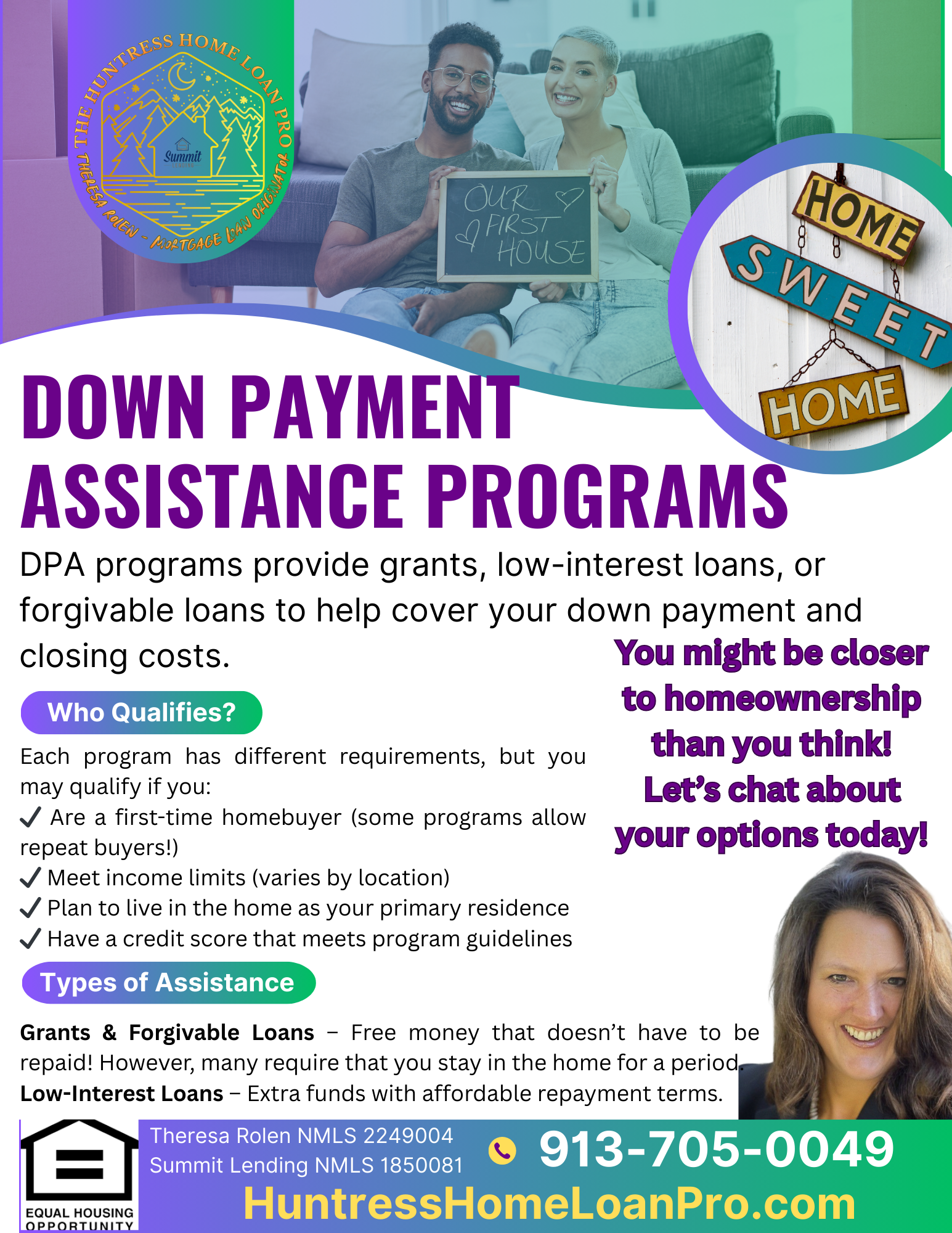

Down Payment Assistance Programs

Down payment assistance programs continue to be a valuable resource for homebuyers across the nation.

There are state and federal programs available with varying payback and forgivable options. Please be sure to fully evaluate any offering. Some down payment assistance programs (DPA's) are fully forgivable if you stay in the home and do not refinance for a specified number of years or may be prorated. If it is a 10-year plan and you only plan to stay in the home for 2-3 years, this may not be the right solution for your situation.

Some DPA's accrue interest, some have higher interest rates than programs without a DPA, and some require monthly payments and are essentially a second mortgage or lien on the property.

Certain restrictions apply. Subject to approval of borrower and investor guideline requirements. Some exclusions may apply.

Interested in our services? We’re here to help!

We want to know your needs exactly so that we can provide the perfect solution. Let us know what you want and we’ll do our best to help.